Superannuation Update - Edition 1

Below is a round-up of some superannuation changes and key developments that may be relevant to you, as trustee of your SMSF. It is important that you know what changes are coming, so you can effectively understand how they may affect you and the members of your SMSF.

We intend to regularly provide you with these updates as a way of helping you plan for your retirement and identify any opportunities that can assist you to grow your superannuation savings.

APRIL 2023

1. Deductibility of personal super contributions and the work test

Since 1 July 2022, there has been a law change that abolished the requirement for anyone aged between 67 and 75 to satisfy a work test – or be gainfully employed – before making superannuation contributions. That is, unless you want to claim a tax deduction for a personal super contribution – which still requires you to meet the work test or rely on the one-off work test exemption.

However, an unintended consequence of this law change has been that some individuals, despite no change in their employment arrangements, may no longer be entitled to a tax deduction. For example, some company directors aged 67 to 75 may be impacted.

To resolve this issue, the ATO has released a draft Legislative Instrument (LI 2023/D11) which is intended to ensure that all individuals aged 67 to 75, who would have been eligible to claim a tax deduction for their personal superannuation.

2. SuperStream Rollover Relief is ending

From 1 July 2023, all trustees will need to have an Electronic Service Address (ESA) and to use the SuperStream system to successfully rollover member benefits. This means all SMSFs actioning a member rollover will be required to receive and send electronic messaging and payments.

Undertaking a rollover without using an ESA after 30 June 2023 will result in a contravention, reportable by your SMSF auditor.

Since March 2022, SMSF trustees that had difficulty getting an ESA have been able to seek approval from the ATO to rollover member benefits to an APRA regulated fund (or to another SMSF), outside of the SuperStream system. Given the number of messaging providers now available and the small number of trustees that needed to seek approval from the ATO, this temporary relief is now set to end on 30 June 2023.

MARCH 2023

1. New tax on large balances

There has been much discussion surrounding the tax treatment of large superannuation balances in recent months, following the Treasurer’s initial announcement that the Government’s intention is to introduce a new tax for fund members with superannuation balances above $3 Million.

The Government has since released a consultation paper seeking input on how this new tax is to be introduced and how changes will be implemented.

Much of the debate, since this change was first announced, has surrounded the way in which ‘earnings’, for the purposes of this new tax, will be calculated – in particular, the inclusion of annual unrealised capital gains through the use of an individual’s Total Superannuation Balance (TSB).

While the details contained in the Government’s consultation paper demonstrate that Treasury’s proposed approach is still evolving, many unanswered questions remain.

FEBRUARY 2023

1. Indexation of Transfer Balance Cap (TBC)

Following the release of the December Quarter 2022 CPI figure by the Australian Bureau of Statistics, the General TBC is set to increase from $1.7 Million to $1.9 Million, from 1 July 2023.

However, it is important to be aware of the proportional indexation approach that is used to calculate every individual’s Personal TBC. This means that for some, the amount they can transfer into retirement phase pensions will increase substantially, while for others there may be no change at all.

2. Indexation of contribution caps and other rates and thresholds

The Australian Bureau of Statistics released the November 2022 AWOTE figure – which essentially confirmed that there will be no indexation to the superannuation contribution caps for the 2023/24 financial year.

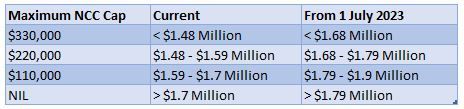

However, the indexed General TBC could have positive flow-on impacts on your ability to make Non-Concessional Contributions (NCCs). If you are seeking to utilise the NCC bring-forward rules, the thresholds are expected to increase on 1 July 2023, as outlined in the table below.

3. Death v Member Benefit

The ATO has updated its online guidance to assist trustees in determining how to deal with situations in which a member requests an amount to be paid from their SMSF before they die, but die before they received it – QC45254.

Based on the updated guidance, the ATO has reminded trustees that they must assess whether the payment is a member benefit or a death benefit based on the facts known at the time of the payment. The ATO has also provided additional specific issues that need to be considered.

Treating a benefit payment one way or the other can have a very different tax outcome and can deliver very different estate planning consequences. Given the specific circumstances surrounding the payment, SMSF trustees have the option to apply to the ATO for a Private Binding Ruling (PBR).

4. Objective of Superannuation

In February the Government released a consultation paper providing a range of options for consideration as it seeks to legislate an objective of superannuation as a way of making sure that super is used for retirement only.

The proposal is not intended to change your obligations as SMSF trustee or the way that your SMSF is regulated. Instead, it is aimed at policy makers to ensure any future changes to superannuation are aligned with the purpose of the system.

The Government’s proposed objective, which is up for discussion, is: “The objective of superannuation is to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way.

JANUARY 2023

1. Transfer Balance Account Report (TBAR)

From 1 July 2023, all SMSF trustees will be required to report TBC events no later than 28 days following the end of the quarter in which the event occurred – even if the member's total super balance is less than $1 million.

This means all unreported events that occur before 30 September 2023 must be reported by 28 October 2023. You can read more on the ATO’s updated web

content outlining the event-based reporting obligations applicable to SMSF trustees.

2. Non-Arm's Length Income (NALI) and Expenses (NALE) - Consultation Paper

In January this year, the Government released a Consultation Paper which put forward several options to amend the NALI provisions to address the potential for disproportionately severe outcomes for breaches relating to general expenses.

For SMSFs the proposed amendments would result in the maximum amount of income taxable at the highest marginal rate being five times the level of the general expenditure breach – calculated as the difference between the amount that would have been charged as an arm’s length expense and the amount that was actually charged to the fund. Where the product of 5 times the breach is greater than all fund income, all fund income will be taxed at the highest marginal rate.

The intent of the Consultation Paper is to facilitate a public consultation process and does not yet represent the Government’s settled position.

3. Downsizer Contributions

From 1 January 2023 , you can make a downsizer contribution if you are 55 or older at the time of the contribution and have satisfied the other eligibility requirements. This is a reduction to the minimum age requirement which was previously set at 60.

All other eligibility rules remain unchanged and the maximum amount of downsizer contributions that can be made remains at $300,000 per person or $600,000 per couple.

4. Commonwealth Seniors Health Card (CSHC)

The income thresholds used to determine eligibility for the CSHC were increased from 1 January 2023.

These income thresholds are currently:

WHAT'S NEXT

Navigating your way through the evolving superannuation rules can be very complex, especially in the lead up to a member’s retirement. If you have any questions, require assistance, or would like to discuss any of the above changes, please feel free to give us a call to arrange a time to discuss.

This article was provided by the SMSF Association. The SMSF Association is an independent, professional body that represents Australia’s self managed super fund sector. The contents of this Super Update are taken to be correct at the time of publication on 2 May 2023.