BLOG

Blog

By Curo Financial Services

•

21 Mar, 2024

Traditionally, life’s big milestones were often summed up as getting married, buying a house, having a baby and later settling into retirement. And while all of these are still momentous and memorable life moments, today there are several other modern milestones to add to that list. These could be launching your own side hustle, investing in a property with a friend, choosing to have a child on your own, or deciding to travel in a campervan. Aside from all these moments being a cause for celebration, these milestones also mark an important point in your life to reconsider the security you have in place to not only protect yourself and everything you’ve worked towards but also the ones you love. Considering Life Insurances Big changes in your life are a time to take stock of the things you’ve achieved, your future goals and what’s important to you. And more often than not, life’s big milestones come with added financial responsibility. For this reason, it’s important to consider how you would continue to meet these responsibilities if something were to happen to you. Pooling money with family or friends to buy property can be a great way to break into the property market, however, it comes with its own unique considerations. In particular, having a plan for how you will manage and share the financial responsibility which extends to how you would cover both your shares of the mortgage if something were to happen to either of you. Life Insurance, Critical Illness Insurance and Total and Permanent Disability Insurance (TPD), are all ways to help protect yourself and people that are important to you, helping ensure that if you passed away or could never return to gainful employment, neither your friends or your family would be left to cover the cost of your financial commitment. Similarly, if you were diagnosed with a Critical Illness or experience a traumatic event that left you totally and permanently disabled, you would have lump sum payment to help offer you financial security and assist with ongoing expenses, or debts. Considering Income Protection While big life achievements are generally a result of considerable planning and preparation, you can’t always predict what will happen in life. This means that if you’re considering launching your own venture as your next big milestone, it can be helpful to have protections in place that can help prevent your goals from being railroaded in the event of an illness or accident. Often, increasing earning power is a motivator to launch a business, so it may be worthwhile considering how you would maintain this financial security if something were to happen to you. Income Protection can give you an alternative source of income if you’re temporarily unable to work due to an illness or injury that's left you totally or partially disabled. Whether you’ve launched a solo side hustle or are working with a small team, it can help you stay on top of personal living expenses, medical costs and business expenses, leaving you to focus on recovering. Every Australian is different and has their own unique ambitions, goals and milestones. If you’d like help reviewing your personal financial situation, please reach out. Any advice is general in nature only and has been prepared without considering your needs, objectives or financial situation. Before acting on it you should consider its appropriateness for you, having regard to those factors.

By Lipins Partners

•

19 Mar, 2024

The March Board meeting of the Reserve Bank of Australia (RBA) concluded with a decision to maintain the official cash rate at 4.35%, following a thorough review of recent economic indicators. The official statement for this decision is available on the RBA's website .

By Lipins Partners

•

05 Mar, 2024

Tax planning is a strategic approach to managing your business’ financial affairs, with the aim of legally minimising your tax liability. In other words, you plan ahead to make sure you pay the taxes you should be paying, but not a penny more. Working with your tax adviser, you can look for deductions, credits, exemptions and tax-saving strategies that will help to optimise your company’s overall tax position. How does tax planning affect your business? The primary goal of tax planning is to reduce the amount of taxes your business owes. But it’s also about making sure you stay compliant with all the tax laws and regulations applicable to your business. But what are the main advantages? Let’s take a look at five of the big benefits of careful, strategic tax planning. By planning your tax across the year, you can: Maximise your profits – strategic tax planning helps your company find the best available tax incentives, deductions and credits. This reduces your overall tax liability, cuts your annual tax costs and increases your overall profitability as a business. Boost your cashflow – tax planning is a great way to open up more liquid cash and achieve a better cashflow position for the business. When you cut down the company’s tax payments, that frees up cash and helps you achieve a positive cashflow position. Stay compliant and mitigate your risk – being proactive with your tax planning keeps the company compliant with the relevant tax laws and regulations. It’s a sensible way to tick the compliance boxes and reduce the risk of costly penalties and legal issues. Drive your strategic growth – smart use of tax planning helps you reduce your tax costs and reassign those funds to your strategic business goals. It’s a golden opportunity to invest in areas that promote long-term growth and competitiveness. Give your business a competitive edge – if managed well, efficient tax planning leads to lower operational costs for the business. This gives you a competitive edge when it comes to pricing, innovation, sales and revenue generation. How can our firm help you with tax planning? Getting strategic with your tax planning has many advantages for your financial stability as a business. But to maximise your planning, it’s important to work with an experienced adviser. As your tax adviser, we’ll help you look ahead across the whole financial year, looking for the opportunities to reduce your tax liability and find the best tax deductions and incentives. If you’d like to know more about the impact of tax planning, we’ll be happy to explain. Get in touch to talk about tax planning.

By Wealth Peak Financial Advice

•

27 Feb, 2024

Last year saw mixed reactions with the economy and markets. Contrary to widespread expectations, markets defied projections, setting aside elevated inflation and increasing interest rates. Surprisingly, most major equity markets demonstrated robust performance, posting strong returns for 2023. After experiencing a consumer-led recovery that surpassed initial concerns following COVID lockdowns, major global economies have encountered a new challenge in recent years: a significant rise in inflation. This inflationary pressure primarily stems from stronger-than-anticipated demand outpacing a slower-than-expected supply response. Consequently, central banks worldwide have been compelled to adopt an assertive approach, increasing interest rates from their emergency lows during the COVID period to curb both demand and pricing pressures. Despite a slowdown in economic growth, Australian and most major global economies have displayed greater resilience than initially anticipated. Global unemployment rates remain low and the feared hard-landing recession scenario has, at least for the time being, been averted. Inflation, while still elevated, is showing signs of moving in a favourable direction. Notably, many central banks are now slowing down the pace of interest rate hikes and are beginning to consider the prospect of lowering interest rates later this year. Three risks that could make for a bumpy landing Nevertheless, we remain cautious, particularly these early days. We have identified three primary risks that have the potential to disrupt our current perspective and lead us in an alternative direction 1. Inflation and interest rates - There remains a possibility that the delayed repercussions of previous interest rate hikes might catch up with the economy, particularly as an increasing number of households and businesses find themselves compelled to refinance previously affordable COVID loans at higher rates. Additionally, the persistence of a sluggish growth environment could potentially instigate a more profound downturn. However, if inflation continues to trend downward, either of these scenarios might result in central banks implementing swifter and more substantial rate cuts, thereby mitigating the extent of the economic downturn. 2. Labour and unemployment - A more concerning risk arises if the deceleration in inflation begins to lose momentum, particularly if wages and inflation in the service sector remain elevated despite tight labour markets. This risk can be mitigated if the overall economic growth continues to ease, leading to a gradual increase in the unemployment rates in countries like Australia and the US, aiming for around 4.5%—hopefully, without precipitating a more profound downturn. If the demand for labour subsides or the labour supply continues to recover, there is a possibility that wages and inflation in the service sector could further decelerate without a substantial increase in unemployment. 3. Geopolitics - A last factor of concern pertains to geopolitical risks—any intensification in the ongoing conflicts in the Middle East and Europe could elevate inflation by disrupting vital global food and energy supplies. Persistent tensions between China and Taiwan also contribute to uncertainty, and the potential re-election of Donald Trump as the US President later this year adds a new unpredictable element to the scenario. In summary, based on our research, it seems that the most probable scenario for 2024 involves a continued, albeit modest, deceleration in economic growth—avoiding a severe recession. This outlook creates room for additional decreases in inflation and subsequent central bank interest rate cuts by the end of the year.

By Lipins Partners

•

20 Feb, 2024

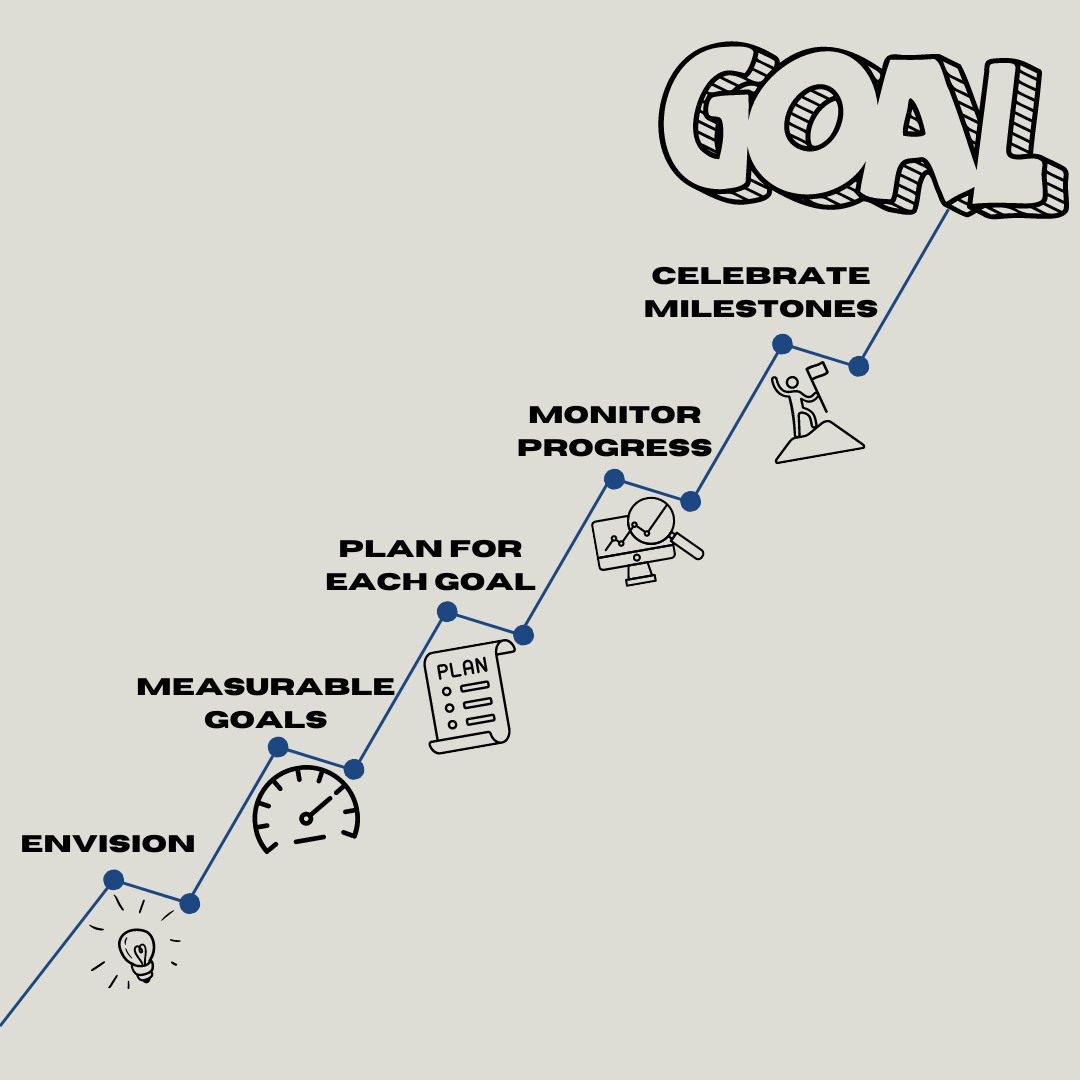

The new year is a new beginning. If you are a business owner, this is often the time of year when you reflect on where you are at and think about your business goals for the year ahead. Setting goals is an essential part of personal and professional growth. These could be lofty goals, or even setting out a plan to achieve some more mundane (but equally important) projects. Whether that is getting paid faster, reassessing expenses or bigger things like automation of processes and new markets. You may be looking to expand your business or create more time for yourself. Having a clear vision and actionable goals can help you achieve your long-term plans. Here are some tips to get you started: Envision your future: Reflect on what you truly want from your life and how your business can help you achieve those aspirations. Consider where you want your business to be in the next five or ten years. Having a clear endpoint in mind will make it easier to set goals that align with your vision. Set measurable goals: Vague goals can be challenging to track and evaluate. Instead, focus on setting goals that are measurable. Think about the key metrics you already monitor in your business and how you would like to see them improve. For example, aim for a 3% increase in net profit year-on-year, a 2% reduction in expenses, or acquiring two new customers per month or grow your prospect database by 50%. If you set specific targets, you can easily track your progress and make adjustments as needed. Develop a plan for each goal: Once you have identified your goals, it's crucial to create a plan of action to achieve them. This can be as simple as jotting down your ideas or engaging in a brainstorming session with your team or advisors. Having a well-defined plan in place will help you stay focused and motivated to follow through. Monitor your progress regularly: It's essential to regularly check in on your progress towards your goals. Set reminders on your calendar or align your monitoring process with your invoicing cycle. By consistently evaluating your progress, you can identify any areas that need improvement or come up with fresh ideas to help you reach your targets. Celebrate your achievements: Celebrating milestones along the way is crucial for maintaining motivation and momentum. Plan a reward for yourself when you achieve a significant goal. It could be treating the team to a morning tea, having a day out of the office together or planning an event for the end of the year. Choose something that brings you joy without breaking the bank. Not sure how to get started? We can help you with the strategy and identifying the information you’ll need to track, so you can monitor your progress. Setting goals is just the first step. By implementing these tips and staying committed to your vision, you can turn your long-term plans into reality.

By Cresco Finance

•

06 Feb, 2024

In its initial gathering for 2024, the Reserve Bank of Australia (RBA) has opted to maintain the cash rate at 4.35 percent. The official statement for this decision is available on the RBA's website , and the subsequent cash rate determination is scheduled for March 19 .

By Lipins Partners

•

06 Feb, 2024

The beginning of a new calendar year is an excellent time to review the year just finished and reflect on what worked, what didn’t, what you’d like to change and new things you’d like to implement. Take the time to review the year and acknowledge all that has happened, good, bad or indifferent. Examining the year with an objective perspective can provide valuable insights to prepare for the next business year. Planning and goal setting will help provide a focus for your business efforts. Your Yearly Business Review What were the most significant impacts on your business in the last 12 months? How well did you meet the challenges? What worked well last year? What systems, technology, products or services were successful? What accomplishments can you celebrate? What situation, event or experience provided the biggest learning opportunity? What is the biggest challenge or frustration you face as you prepare for the year ahead? What did you most enjoy during the year? Do more of it. What did you least enjoy? Do less of it! Analyse your financial reports. Are you earning what you’d like to? Is the business sustainably profitable? Get Ready for a Great Year While there are many metrics you could evaluate to track business performance, we’ve given you just a few ideas to inspire your business planning for a positive start to the year. If you’d like to chat about what you can do differently this year to enable your business to thrive, book a time with us today.

By Lipins Partners

•

30 Jan, 2024

Budgeting is about estimating your revenues, projecting your expenses and detailing the allocation of funds, so you stick to (and don’t overrun) your agreed budget ceiling. How does budgeting affect your business? Having a clear, agreed budget gives you a structured framework for your financial decision-making. It’s a practical way to control your costs, monitor performance and adapt your strategic and financial decisions to meet changing economic conditions. Using budgeting helps your business in a number of ways: Better control over your finances – budgeting gives you a clear roadmap for managing your company’s finances. Sticking to that budget helps you maintain control over expenses, reduce wastage and make the very best of your resources. Achieving your financial and strategic goals – your budget helps you to set and track financial goals, making it easier to align your business strategies with your desired goals and outcomes. It’s a great way to boost growth, profitability and debt reduction. Improved control over your cashflow – effective budgeting helps you anticipate any cashflow fluctuations. That’s a bonus that helps you plan for both lean and prosperous periods, making sure you have the funds to cover expenses and seize opportunities. Allocating your resources – budgets are useful for guiding how and where you allocate your resources. From your one pot of cash, you can decide whether to prioritize investments, marketing efforts, operational improvements or business growth. Keep track of your performance – comparing your actual financial results to your budgeted results helps you quickly assess your performance as a business. You can look for variances, make timely adjustments to stay on track toward your goals. How can our firm help you with budgeting? Being in control of your expenses, spending and predicted revenues sits at the heart of your financial management, giving you a framework and set budgetary goals to aim for, track against and (hopefully) achieve. As your adviser, we’ll help you set up budgets for your strategic business plans, with clear tracking and reporting to keep you on the ball and meeting those targets. Get in touch to chat about budgeting.

By Lipins Partners

•

23 Jan, 2024

Need a hand managing cash flow? You’re not alone. The key is getting your invoicing right, by invoicing customers as soon as possible and using tools like Xero’s invoice reminders to move payments along. That said, there are a few other simple rules you can apply to manage your cash flow and get your invoices paid even faster: Keep your books accurate and up to date - so you can see your financial state at a glance. Don’t be too lenient with your customers - you can be direct and still polite. Keep a close watch on your accounts receivable turnover at all times and act sooner rather than later. Keep your accounting simple - so you have a good handle on these business metrics. We can help with this. Keep your business and your professional finances separate - this is essential to understanding your true cash flow position. Mixing your business and personal finances can leave you uncertain about business performance. Build a cash reserve - so you are prepared for unexpected events and can take advantage of opportunities when they pop up. First you want to get your invoicing right. Get into a habit of sending invoices quickly. Then follow the steps above to collect revenue and keep your finances organised. Cash flow management is the lifeline of your business and given post covid price rises and inflation we recommend you contact us to discuss and better manage your quarterly cash flow requirements

By Lipins Partners

•

16 Jan, 2024

As we welcome 2024, it's an important time to prioritise your estate planning and family wealth protection. Making these resolutions now can provide you with a sense of achievement and relief from the weight of uncertainty. Here are the top ten resolutions you should start on immediately to ensure your family's future is secure.

Copyright Lipins Partners ©

| Disclaimer

| Sitemap

| Web design by Wolters Kluwer